Helping keep our team healthy.

Health plans designed to promote wellness

We offer comprehensive and affordable medical, dental, and vision benefits to our full-time and part-time employees and their eligible family members – as well as a tobacco-free work environment. It’s just one of the ways we show our employees that they make a difference.

Traditional and High Deductible Medical Plans

We offer full-time employees a choice between a Traditional Plan and High Deductible Plan and part-time employees are offered a High Deductible Plan. Coverage is available to you and your eligible dependents. For the medical plans, eligible dependents include legal spouses and eligible children up to the end of the month they turn 26, except in the case of permanent disability. If a legal spouse is offered coverage through their employer, they must take the coverage and cannot be enrolled in Northwest’s medical plan.

All plans provide comprehensive medical coverage, but function differently. Consider your individual needs to determine the right plan for you.

- The High Deductible Plan has a lower employee bi-weekly rate than the Traditional Plan but has a higher deductible before your insurance starts to pay. If you enroll in a High Deductible Plan, you are also eligible to save pre-tax monies to a Health Savings Account (HSA). This money can be used to pay your deductible and other out-of-pocket costs.

- The Traditional Plan has a higher employee bi-weekly rate than the High Deductible Plan but a lower deductible

Both medical plans currently provide in-network access to over 98% of doctors and hospitals throughout the United States.

View a comparison of full-time employee health plans and premiums

View a comparison of part-time employee health plans and premiums

Dental Plan and Premiums

Coverage is available to you and your eligible dependents. Eligible dependents include your legal spouse and unmarried children under age 19, or under age 25 if a regular full-time student in an accredited technical school or school of higher education, as well as children who are totally and permanently disabled who became disabled prior to reaching age 19. Benefits are paid at different rates depending upon the procedure required.

Our dental plan has no deductible. The dependent eligibility, maximum benefit amount per calendar year, and employee premiums are determined by full-time vs. part-time employee status.

View a comparison of full-time employee dental plans and premiums

View a comparison of part-time employee dental plans and premiums

Plans include access to United Concordia Dental

Vision Plan

Coverage is available to you, your legal spouse, and children under age 25 as well as unmarried children who are totally and permanently disabled and who became disabled prior to reaching 25 years of age.

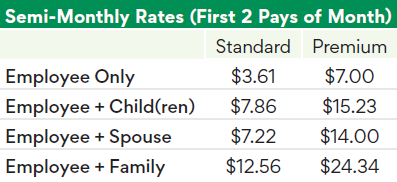

Northwest provides a choice between two affordable plans — the standard and premium vision package.

View a comparison of vision plans

Suggested Reading

This communication provides information about certain Northwest benefits. Receipt of this information does not automatically entitle you to benefits offered by Northwest. Every effort has been made to ensure the accuracy of this communication. However, if there are discrepancies between this communication and the official plan documents, the plan documents will always govern. Northwest retains the discretion to interpret the terms or language used in any of its communications according to the provisions contained in the plan documents. Northwest also reserves the right to amend or terminate any benefit plan in its sole discretion at any time for any reason.

Benefits information shown on this website are examples only and are not guaranteed to be accurate. Rates and coverages are subject to change at any time. Nothing on this page should be construed as a guarantee of benefits eligibility if hired by Northwest Bank.