Customer Relief Solutions

We recognize that some of you are facing financial hardships as a result of the coronavirus pandemic. We're here to help our customers and communities during these challenging times.

-

Consumer, Home Equity, and Mortgage Loans

-

Paycheck Protection Program Forgiveness

-

National Coin Shortage

Consumer, Home Equity, and Mortgage Loans

If you're unable to make your full monthly loan payment, you may be eligible for short-term relief.

If you're interested in receiving information on this option, please fill out this form.

After you complete the form above, we'll email you information about a short-term relief option that may be available to you. Please review this information and click the enclosed link if you're interested in applying. A Northwest Bank representative will contact you on a recorded line within 1-3 business days, Monday - Friday, to discuss partial payments and other terms and conditions. After the short-term modification has been approved, all borrowers must sign and return the short-term agreement with any partial payment.

If you have any questions, please contact your local office or call our Customer Contact Center at 1-877-672-5678.

Business Assistance

If your business has been affected by coronavirus, we can provide relief solutions and help you better understand the current government loan assistance programs. To find out more, contact your business lender, treasury management advisor, or our Customer Contact Center at 1-877-672-5678.

Small Business Administration (SBA) Programs

At Northwest, we care about our Small Business and Commercial clients and are committed to helping businesses navigate these challenging times. As a long-standing Preferred SBA Lender, we have been closely following the SBA and its lending programs for use in COVID-19 relief. Our experienced team of SBA lenders are well-versed in SBA loan programs and are dedicated to providing your business guidance and advice as the government delivers assistance programs and options to support your business.

Paycheck Protection Program (PPP)

Through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, relief dollars were allocated to help small businesses through the coronavirus pandemic. Within this Act, the government authorized the Small Business Administration (SBA) to back Paycheck Protection Program (PPP) loans through local lenders.

We are pleased to announce that Northwest Bank’s PPP efforts generated 7,369 loans that provide more than $720 million worth of relief.

On May 5,2021, the U.S. Small Business Administration announced that “after more than a year of operation and serving more than 8 million small businesses, funding for the bi-partisan Paycheck Protection Program (PPP) has been exhausted.”

The SBA has closed loan origination capabilities on their platform. As a result, we are no longer able to originate PPP loans through our online application portal.

Forgiveness applications and forgiveness portal access are not impacted by this change.

Information for Northwest PPP Customers About Forgiveness

If you’re a Northwest PPP customer, we hope that loan forgiveness— which is a key driver of the program—is on your mind. It’s certainly on ours.

As we monitor what’s happening in Washington, we've developed an easy-to-use portal to facilitate the forgiveness process. Through this portal, you’ll be able to-

- Electronically submit and sign your PPP forgiveness application

- Upload supporting documentation

- And, communicate directly with our team

To access the portal, click here.

Keep in mind, the portal is the only way to apply for forgiveness through Northwest. We will not be accepting paper applications.

We encourage you to continue to review the guidance for forgiveness and gather required documentation. Please visit the SBA's website for the latest on PPP loan forgiveness.

Applying for Forgiveness

We recommend that you read up on all the forgiveness rules and requirements. You’ll find the latest on the PPP and forgiveness guidance on the SBA's website.

What’s most important is that you make sure you are doing everything within the regulation to maximize the amount of forgiveness you can receive.

As a Northwest PPP customer, you should have received an email with detailed instructions on how to start the loan forgiveness process using our online portal. If you did not receive that information, please email pppforgiveness@northwest.com or contact your Northwest relationship manager.

Keep in mind, our portal is the only way to apply for forgiveness through Northwest. We will not be accepting paper applications.

In September, we released the list of FAQs below to help answer additional questions that may be on your mind.

How does forgiveness work?

If you use your loan's proceeds on qualifying expenses, up to 100% of the principal amount and any accrued interest may be forgiven by the SBA.

Keep in mind, there are certain conditions that may reduce your forgiveness amount-- including a reduction in the number of full-time employees or a decrease in salaries and wages.

What’s a qualifying expense?

To qualify for full loan forgiveness, you must use at least 60% of the funds for payroll. The remaining 40% must be spent on approved non-payroll expenses like utilities and mortgage, rent or lease expenses.

- What counts as payroll costs?

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee);

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit;

- State and local taxes assessed on compensation; and

- For a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee.

Can I submit my forgiveness application in paper form?

No. We are not accepting paper applications. Access our easy-to-use online portal here.

When will I be able to submit my forgiveness application?

Once your covered period is over, you can apply.

Which form should I use?

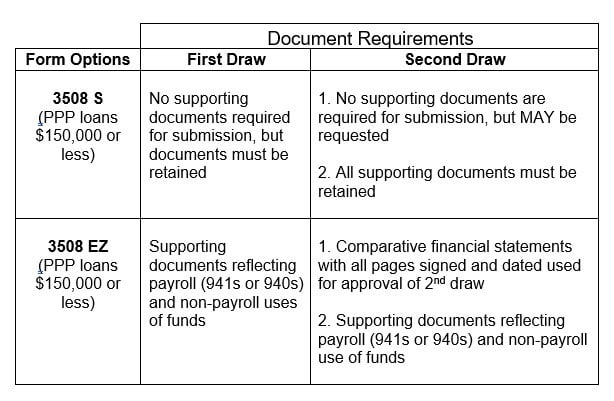

For PPP loans of $150,000 or less, you must use either the 3508S (streamlined and most commonly used) or 3508EZ form (see chart below for requirements). For PPP loans above $150,000, you must use either the 3508 EZ or 3508 FULL form.

Supporting documents may include Federal 941 quarterly statements, cancelled payroll checks, utility bills, lease payments, bank statements etc.

I’m concerned about missing a loan payment—do I owe money now?

-

If you plan to apply for forgiveness and submit your forgiveness application prior to your first payment due date, your payments will be deferred until SBA completes their review and determines eligibility.

- If you don’t plan to apply for forgiveness or if forgiveness isn’t granted because you didn’t meet the criteria listed above, your monthly payments will be deferred for 10 months after the last day of your “covered period”.

- Covered period = You have the flexibility to choose a period of time between 8 and 24 weeks to have used the funds for covered expenses.

Monthly payments of principal plus interest will be due after the end of your deferral period.

If my loan is not forgiven, how much is my monthly payment?

It depends on your loan amount and maturity date.

Loans approved on or after June 5, 2020 will have a maturity of five years, and any loan approved before June 5, 2020 will have a maturity of two years, unless there is an agreement to extend the period to five years.

All PPP loans have a fixed interest rate of 1.00%.

If you don’t plan to apply for forgiveness, contact your Northwest relationship manager, who can help you figure out what your monthly payment will be.

Will Northwest pay fees to third-party agents who help clients with the preparation of PPP loan applications?

In the absence of a pre-loan approval written agreement between the agent and Northwest, Northwest does not pay fees or other compensation to agents who represent or help borrowers through the Paycheck Protection Program.

If granted forgiveness, when will I receive my funds?

If granted full or a portion of your forgiveness, the funds will be applied to your Northwest PPP loan within 7-10 business days after you receive official notification from the Small Business Administration.

When issued, you can find this notification through our forgiveness portal, under the Documents tab. Be sure to keep this notification and all other PPP documentation in your records for at least six years, as recommended by the SBA.

I received an EIDL Advance- does that impact my PPP forgiveness?

- EIDL Advance does not have to be repaid.

- Businesses who received an EIDL Advance in addition to the Paycheck Protection Program (PPP) loan will no longer have the amount of the EIDL Advance subtracted from the forgiveness amount of their PPP loan.

What happens if my loan is not forgiven or only partially forgiven?

You will receive a letter from Northwest with your loan balance amount and options for repayment.

How does my PPP loan impact my plan to sell a portion or all of my business?

Read guidance from the Small Business Administration, released October 2, 2020. If you have additional questions, consult your legal or tax professional.

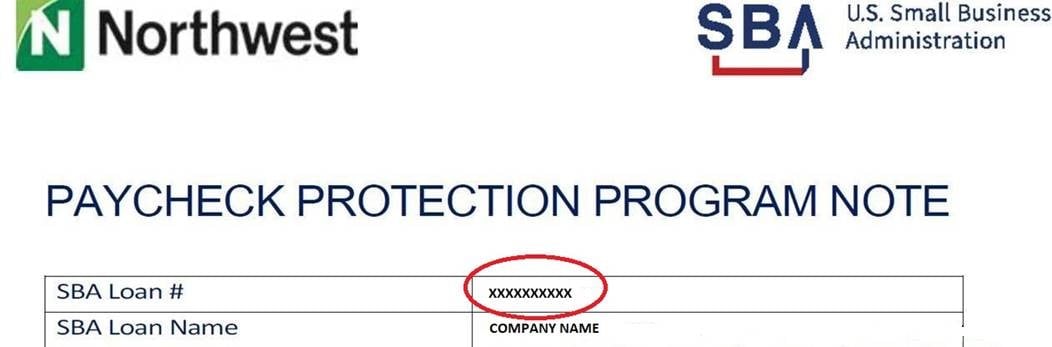

Where can I find my SBA loan number?

You can find your SBA loan number at the top of your Paycheck Protection Program closing documentation, as seen below. If you can’t find your SBA loan number, please contact your Northwest relationship manager.

I received a call or email from a company offering to help me with the PPP loan forgiveness process. Is this company affiliated with Northwest?

No. Other than Lenders Cooperative, the company that provides our forgiveness portal, and Docusign, which allows us to collect electronic signatures, we are not affiliated with any other company offering PPP services.

Where should I go if I have questions?

Please visit the SBA’s website for detailed information about the forgiveness process, covered periods, the type of costs that are eligible for forgiveness and what documentation you will need to submit with your application.

Disclaimer: Borrower acknowledges that Lender is acting solely as the processor in connection with your application for forgiveness of your Paycheck Protection Program Note. Lender shall not be liable to Borrower or any third person for the correctness, validity or genuineness of any instruments, documents or representations released or endorsed to Borrower or the SBA by Lender. Moreover, Borrower agrees that Lender shall not pay any agent fee or any other fee to any third-party associated with any work performed on behalf of the Borrower. To the extent that Borrower has sought any independent legal or accounting advice to complete its application, Borrower acknowledges that Lender did not engage any such agent on Borrower’s behalf and that Lender will not pay for any third-party fee of any type, including any agent fee, to any entity or agent for such work.

The impacts of the national coin shortage

Offices throughout our retail network are currently experiencing a coin shortage. This coin shortage is impacting businesses and financial institutions across the country and is a side effect of the COVID-19 pandemic.

Why is this happening?

The U.S. Federal Reserve announced their coin inventory has been reduced to lower-than-normal levels due to COVID-19. Specifically, the Fed has seen a significant decline in coin deposits from banks. And, in order to protect its employees, the U.S. Mint temporarily closed and stopped coin production.

In light of this, on June 15 the Fed began rationing their shipments of pennies, nickels, dimes, and quarters to all financial institutions. The ration will remain in effect until both the U.S. Mint’s inventory and the recirculation of coins in the marketplace return to normal.

What can you do?

- Rather than cash, use alternate payment methods like debit and credit cards, checks, or P2P services like Zelle® or Venmo when you can.

- Or—use coin when making purchases at local businesses.

- If you’re a business, now’s a great time to think about accepting alternate forms of payment. Through Northwest Merchant Services, you can accept debit, credit, and gift card payments in-store, online, or on-the-go through your mobile device.

- Roll your change and deposit it into the bank. It will help ensure it gets into the hands of the customers and businesses who really need it.