Supporting What’s Next—for your family, your business and all of Fishers

So many reasons to switch to Northwest Bank!

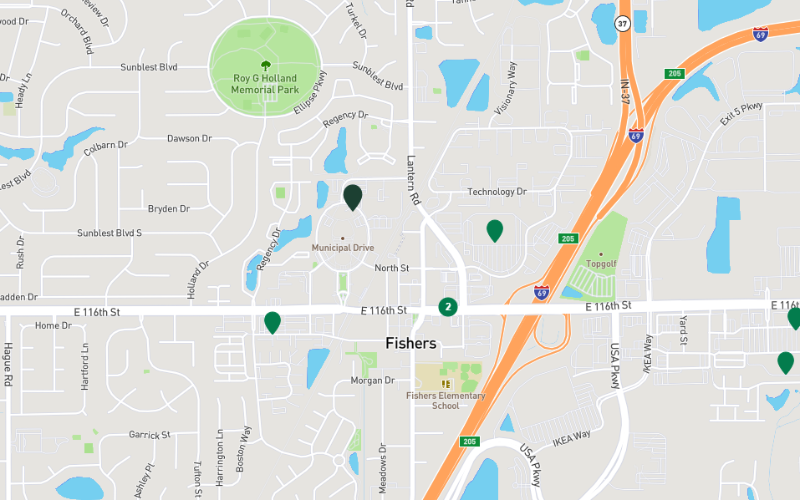

With a full-service financial center in the heart of Fishers and the latest online and mobile banking capabilities when you’re on the go, there’s never been a better time to put our 125 years of banking experience to work for you.

Great rates, big savings, special account opening bonuses and more.

More tools to reach your financial goals

Invested in the Fishers Community

About Us

Currently, Northwest Bank operates 151 full-service financial centers and 10 drive-up locations across Pennsylvania, New York, Ohio and Indiana and provides customers fee-free access to more than 55,000 ATMs across the United States.

Our Solutions

Taking care of your banking so you can take care of business.

What makes a great banking partner? A team that acts as an extension of your company. Understands all angles of your business. Develops realistic plans for achieving your current and future goals. All so you can focus on what you do best.

1To qualify for the $300 checking bonus, open a Northwest Affinity Checking or Affinity Plus Checking account by 10/31/2025 at our Fishers, Indiana Financial Center and make direct deposits totaling $500 or more within a single statement cycle within the first 3 statement cycles from account opening. To qualify for the $600 checking bonus, open a Northwest Affinity Premier Checking account by 10/31/2025 at our Fishers, Indiana Financial Center and make direct deposits totaling $2,000 or more within a single statement cycle within the first 3 statement cycles from account opening. A qualifying direct deposit is an Automated Clearing House (ACH) credit, which may include payroll, pension or government payments (such as Social Security). The bonus will be deposited into your new account within 90 days of completing qualifying activity requirements. To receive the bonus, your checking account must be open and in good standing. Offer is not available to existing Northwest checking account customers or to those with a Northwest checking account that has been closed within the last 12 months. Northwest Bank reserves the right to limit each customer to one new account-related bonus per calendar year. Eligibility may be limited based on your account type and ownership role. Bonus is subject to IRS 1099-INT reporting or, if you do not possess a Social Security number or Individual Taxpayer Identification number, you will be reported on IRS form 1042-S. Employees of Northwest Bank, its affiliates, and subsidiaries are not eligible for this offer. Cannot be combined with any other offer. Offer subject to change, including cancellation, at any time without notice. Promo code FSH25NW must be entered at time of account opening.

2 Early Pay is a free service made available on eligible checking accounts enrolled in direct deposit. Early Pay grants you access to your eligible direct deposit payments up to two days prior to the scheduled payment date. Early availability is based on the timing of the payer’s payment instruction and standard fraud prevention restrictions apply. Early access to direct deposit will not occur on weekends or holidays and is based on when the originator provides payment details. If originator does not send the deposit in a timely manner, your deposit will arrive on the original scheduled date.

3 $25 minimum balance required to open. The advertised APY (Annual Percentage Yield) of 3.75% requires balances of $100,000.00 or more. To qualify for the promotional offer rate, you must increase your total deposit relationship by $25,000 or more of new money. New money is defined as funds not currently on deposit with Northwest Bank. For balances between $0.01 - $4,999.99 the APY is 0.15%. For balances $5,000.00-$49,999.99 the APY is 3.45%. For balances $50,000.00-$99,999.99 the APY is 3.70%. This account is a variable rate account and subject to change at any time without notice. Interest compounds monthly. Fees may reduce earnings. Account holder must have the matching Affinity Plus or Premier Checking account or maintain a $2,500 minimum average daily balance to avoid monthly service charges.

4 All cards subject to credit approval. Cards are issued by Northwest Bank pursuant to a license from Visa USA Inc. Cash back can be redeemed as statement credit. To learn more about our Visa® Signature benefits, visit northwest.com/credit-cards. See Bank for current terms and conditions.

5 HOME EQUITY LOANS: Rates and payment example are based on loans secured by properties located in PA, OH and IN only. Closed-end home equity loan Annual Percentage Rate (APR) as of 5/15/2025 applies to 120-month term for at least $100,000 loan with a minimum of $25,000 in new money borrowings with automatic transfer service from a Northwest checking account, 85% maximum loan-to-value, and 700 minimum FICO score. Not for the purchase of homes. Valid on 1 to 2 unit primary residences only. Maximum loan amount $750,000. Title search required on loans greater than $250,000. Title insurance required on loans greater than $500,000. For example: The monthly payment on a 5.875% APR 120-month loan of $100,000 is $1,104. Payments do not include amounts for taxes and insurance premiums. Actual payment obligation may be greater. Listed APR may be available for Choiceline fixed-rate lock-in. Rates subject to change at any time without notice. Other rates and terms available. Subject to credit approval. APPRAISAL CREDIT: Must submit application by 10/31/2025 to the Northwest Bank Fishers Financial Center. Home Equity Appraisal Credit up to $525, will be credited back at loan closing. Amount may not cover full cost of appraisal. Valid on 1 to 4 unit primary residences only. Offer may be extended, modified or discontinued at any time without prior notice and may vary by market. Offers may be changed or withdrawn at any time. See Bank for details. NMLS# 419814.

6 Must submit application by 10/31/2025 to the Northwest Bank Fishers Financial Center. Mortgage Appraisal Credit up to $525 will be credited back at loan closing. Amount may not cover full cost of appraisal. Valid on 1-to-4 unit primary residences only. Offer may be extended, modified or discontinued at any time without prior notice and may vary by market. Subject to credit approval. See Bank for details. NMLS# 419814.